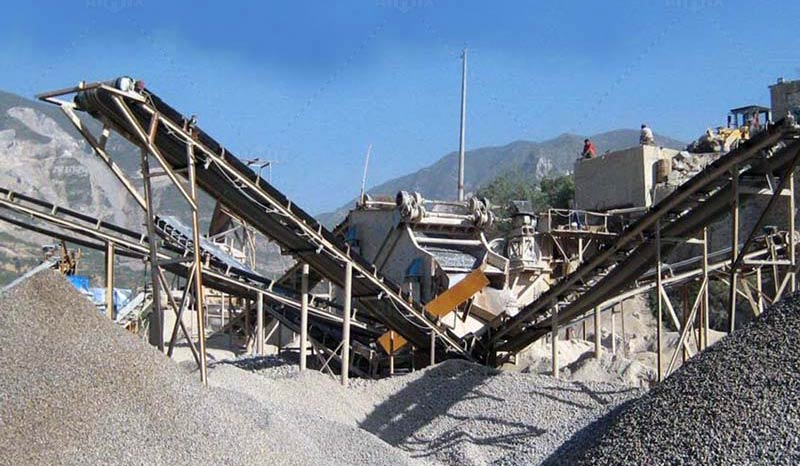

Selecting the optimal production capacity for your stone crushing operation represents one of the most consequential financial decisions in aggregate processing. The leap from modest 50-ton-per-hour setups to industrial-scale 500 TPH configurations involves far more than simple arithmetic - it demands careful consideration of capital expenditure, operational efficiency, and long-term profitability. While higher output stone crusher machine plant promise greater revenue potential, they also introduce complex variables that can dramatically impact your bottom line. Understanding these financial implications requires examining three critical dimensions: equipment investment, operational scalability, and hidden cost factors that often escape initial budgeting calculations.

Capital Investment: The Exponential Cost Curve of Capacity

Primary Crushing Equipment Considerations

The heart of your cost analysis begins with primary crusher selection. A 50 TPH jaw crusher might represent a manageable $150,000 investment, while a 500 TPH primary gyratory unit could exceed $1.5 million. This tenfold capacity increase doesn't translate to linear pricing - premium features like hydraulic adjustment systems and wear-resistant alloys command disproportionate price premiums at higher capacities.

Secondary and Tertiary Crushing Implications

Downstream processing equipment follows similar economic patterns. Cone crushers for 500 TPH operations require substantially heavier frames, larger motors, and more sophisticated automation than their smaller counterparts. The supporting infrastructure - from reinforced foundations to heavy-duty conveyors - compounds these costs exponentially rather than incrementally.

Operational Economics: Balancing Throughput and Efficiency

Energy Consumption Dynamics

Power requirements reveal surprising nonlinearities in crushing economics. While a 50 TPH crusher plant might operate efficiently on 200 kW, a 500 TPH crusher plant installation could demand 1,800 kW - nine times the power for ten times the output. This disproportionate energy intensity stems from the physics of particle reduction, where larger volumes require exponentially more crushing energy per ton as feed sizes increase.

Labor Cost Distribution

Human resource expenses demonstrate more favorable scaling. A small operation might require five workers at $25/hour each, while a ten-times-larger plant could operate with just eight personnel. This labor efficiency advantage makes high-capacity plants particularly attractive in regions with rising wage costs, though it demands substantial upfront automation investments.

Hidden Cost Factors: The Budget Variables You Can't Ignore

Maintenance and Wear Part Replacement

High-capacity crushers consume wear parts at accelerated rates. A 500 TPH plant's manganese liners might require replacement every 800 hours versus 1,500 hours in a 50 TPH configuration. These accelerated maintenance cycles add hundreds of thousands annually to operational budgets - costs often underestimated during initial planning phases.

Site Preparation and Infrastructure

The civil works required for large-scale operations present another budgetary challenge. Where a small rock crusher plant might need simple gravel pads, industrial installations demand reinforced concrete foundations capable of withstanding thousands of tons of dynamic loading. Access roads must accommodate heavy haul trucks, and electrical substations often require costly upgrades to handle massive power draws.

Strategic capacity planning ultimately requires matching your equipment to both current needs and projected growth. While 500 TPH plants offer compelling economies of scale for established operators, their substantial capital requirements and operational complexities can overwhelm smaller enterprises. The sweet spot often lies in modular, scalable systems that permit incremental capacity expansion as market conditions warrant - an approach that balances ambition with financial prudence in the volatile aggregates industry.